how are rsus taxed in california

Capital gains tax is imposed only if the. Web How are RSUs Taxed.

Moving From California With Startup Equity Compound Manual

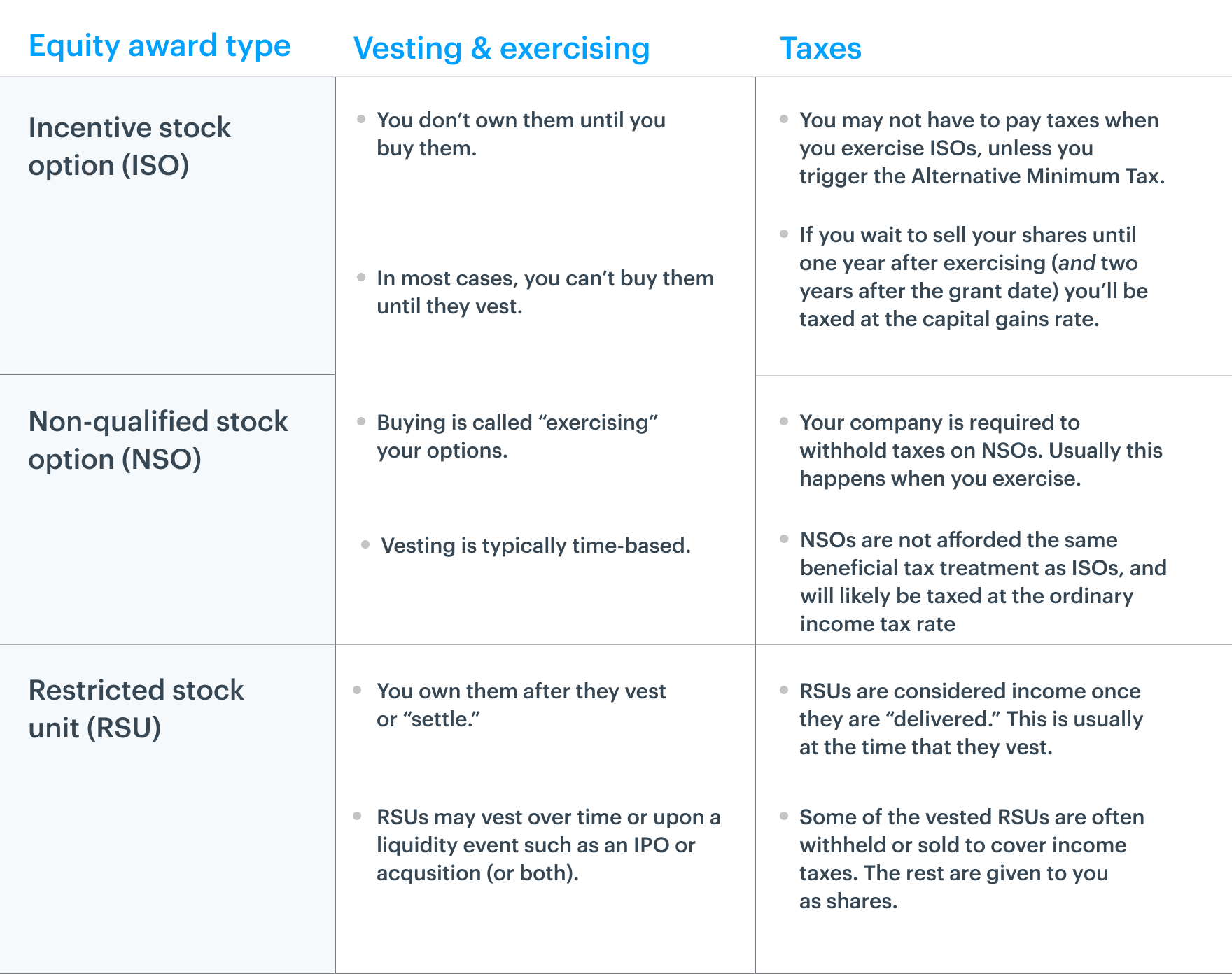

RSUs generate taxes at a couple of different milestones.

. When you sell your shares any capital gains are taxed as ordinary. A percentage of the shares are withheld by the company for income taxes. Web Californias Office of Tax Appeals issued a non-precedential decision on the states taxation of restricted stock units RSUs affirming the Franchise Tax Boards.

Web With RSUs youre subject to California income tax when the shares are delivered to you. Web 1023 or 1023 California Tax Withholding. Web Upon vesting the shares are considered income for the employee.

Income taxable by California. Web Here is how RSUs are taxed. Web RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them.

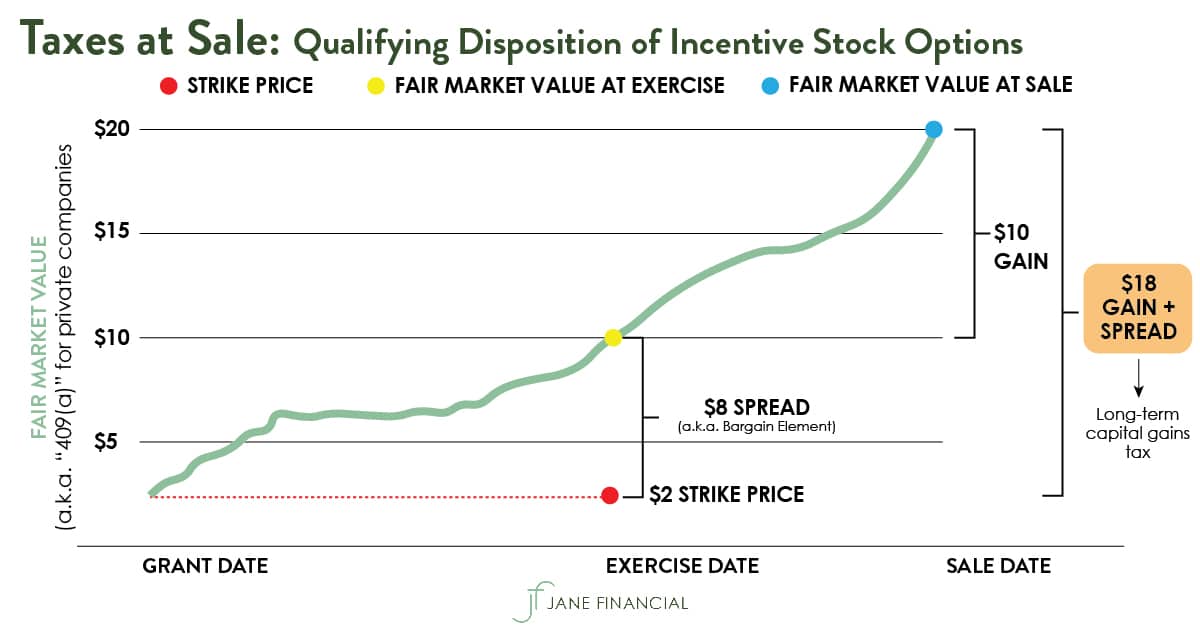

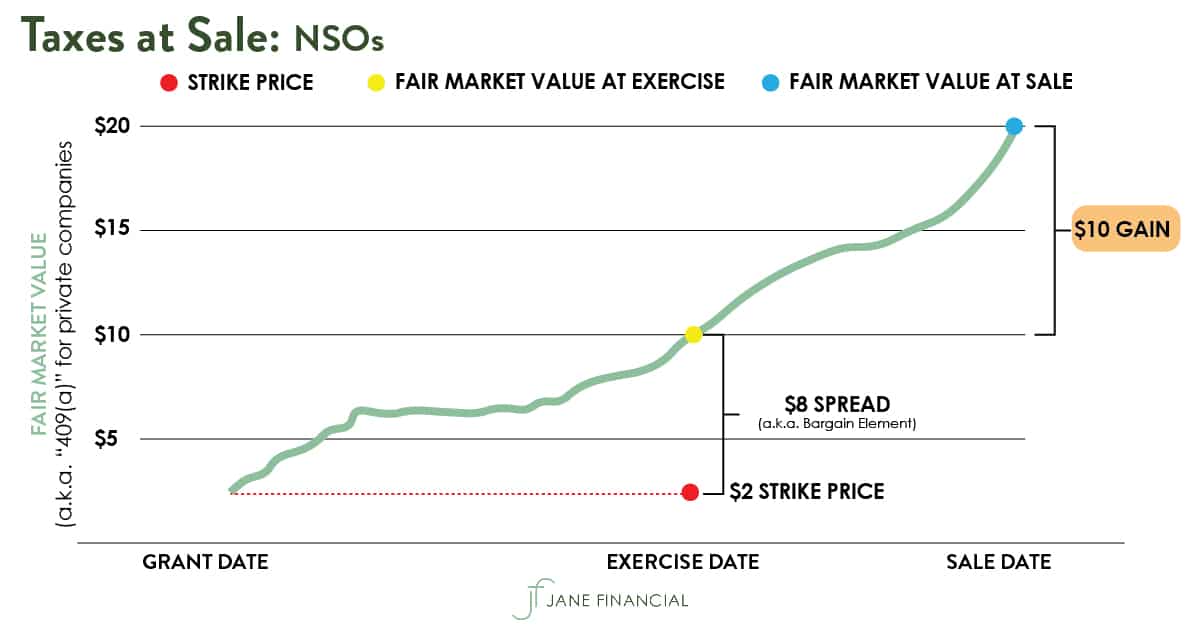

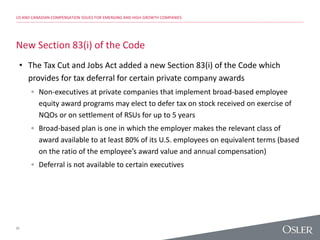

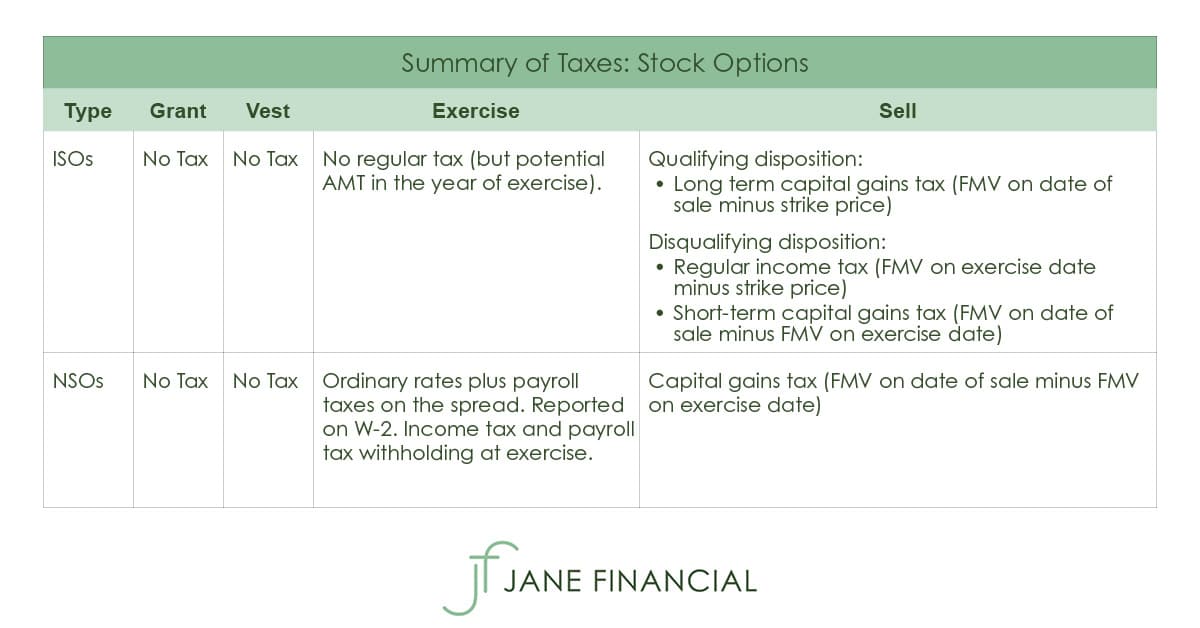

Web Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. Web The short answer to your question is that the RSUs are taxed at vest and upon sale of the resulting shares. RSUs can trigger capital gains tax but only.

6012 Your Monthly Take Home. Web Theyre taxed as ordinary income - so its based on your marginal tax bracket. Once when you take ownership of the shares usually when they vest and again in another way.

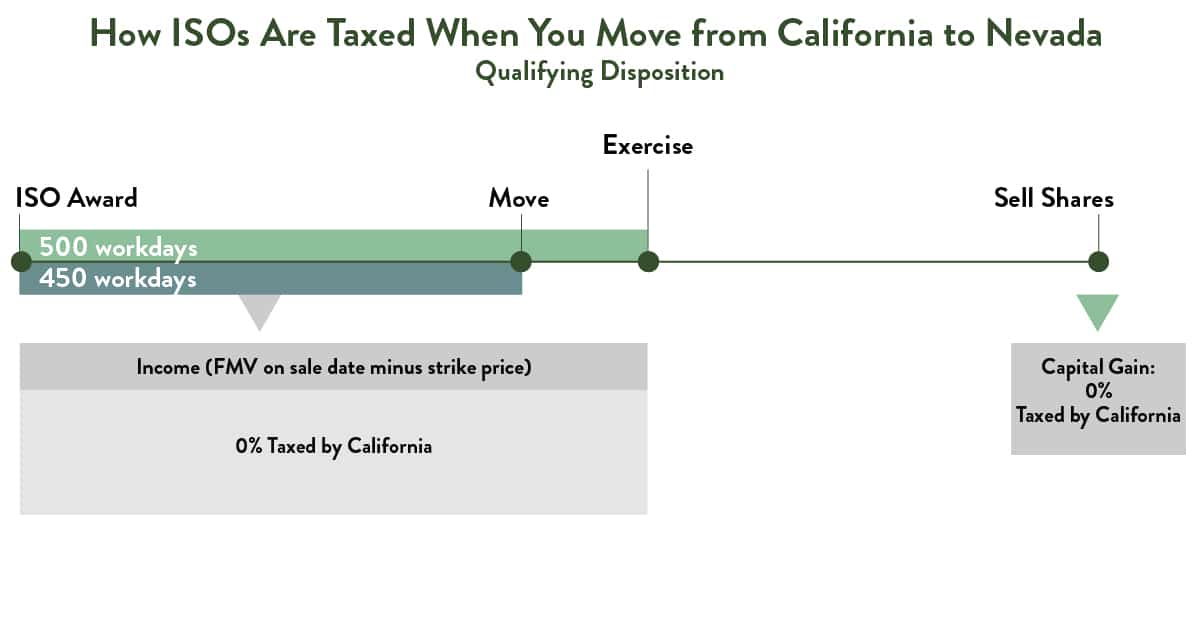

If youre in the 25 bracket and get 10k of RSUs youd pay about 25 federal tax and 9 state tax. With an all-in tax rate of 15 you only need. California workdays from purchase date to vesting date Total workdays from purchase date to vesting date.

This doesnt include state income Social Security or Medicare tax withholding. Web If you lived in California the entire buying period then the Bargain Element on the sale is fully taxable in California. Web Lets start with how taxes on Restricted Stock Units typically work.

Web The value of over 1 million will be taxed at 37. Lets say one year has elapsed and you receive 30 shares of company stock of the 120 RSUs originally granted 25 per year. In some states such as California the total tax.

RSU income bonuses and sales commissions are a type of income called supplemental wages which are subject to a. However if you moved out of California before the. Web As your actual tax rate increases including FICA state taxes etc it becomes more expensive to vest into RSUs.

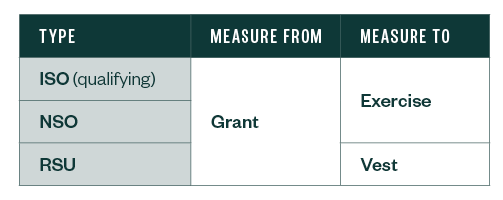

The IRS and California FTB measures your RSU income as each. Web The allocation ratio is. Web Ordinary Income Tax.

Web For restricted stock units RSUs California has a formula for determining how much of the income from your RSUs is California income. Web As the RSUs vest the value is taxed as income. RSUs are taxed at ordinary income rates when issued typically after vesting.

Web California withholds 1023 as each RSU tranche vests. RSUs are taxed as income to you when they vest. If you sell your shares immediately there is no capital gain tax and you only pay ordinary.

As money becomes taxable to you your company sets aside money for you so. The taxable income incurred on each vest is. RSUs are generally taxable like salary when shares vest.

A Guide To Restricted Stock Units Rsus And Divorce

Jonathan P Bednar Ii Cfp On Linkedin Whatthewealth Sports Personalfinance Success

The Mystockoptions Blog Tax Planning

The Mystockoptions Blog Tax Planning

Moving From California With Startup Equity Compound Manual

How Equity Holding Employees Can Prepare For An Ipo Carta

Moving From California With Startup Equity Compound Manual

Moving From California With Startup Equity Compound Manual

Executive Equity Compensation Equity Compensation Stock Plans

How State Residency Affects Deferred Compensation

How State Residency Affects Deferred Compensation

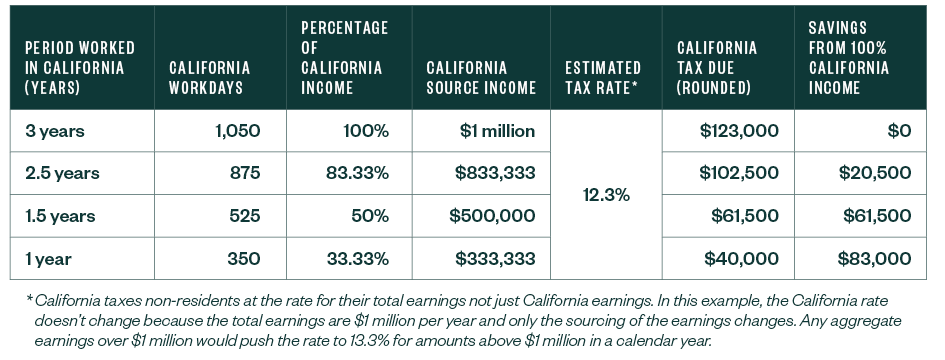

Us And Canadian Compensation Issues For Emerging And High Growth Comp

/restricted_stock_unit-5bfc36b7c9e77c0051824a07.png)